Global Motorcycle Sales In Free Fall Due To COVID-19

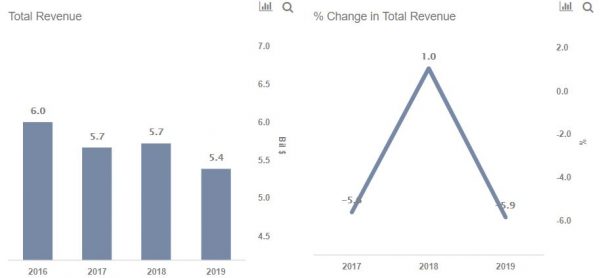

by Dustin Wheelen from https://www.rideapart.com Even before the World Health Organization declared COVID-19 a pandemic on March 11, 2020, many financial experts were speculating on the impact of the global crisis. Once motorcycle manufacturers and dealerships closed their doors to observe social distancing orders and promote public safety, we knew that the market could undergo a massive reduction in productivity and sales. Now that economic reports for the month of March are available, we’re able to assess the impact on the industry—and it isn’t good. We all knew that global motorcycle sales stumbled in 2019, but with the advent of the novel coronavirus, we could see a further decline for markets like India and a contraction of previously growing sectors in Europe. In India, the world’s largest motorcycle market, domestic manufacturers saw steep downturns in March. Year-over-year sales figures declined for Hero MotoCorp (-43 percent), Royal Enfield (-44 percent), Bajaj (-55 percent), and TVS Motor Company (-62 percent) during the third month of 2020. Foreign makes weren’t immune to the economic slowdown with Suzuki India selling 42% less units during the period as well. Not all the news was bad though, as Honda Motorcycle & Scooter India managed to increase sales by 10 percent. Despite the bleak numbers, Suzuki India Managing Director Koichiro Hirao emphasized the company’s responsibilities during the global pandemic. “At present, our first and foremost priority is to ensure the health and safety of the employees and all stakeholders,” said Hirao. “As the industry fights the COVID-19 pandemic by implementing shutdowns and taking precautionary measures, we believe that industry will overcome this difficult time and bounce back with positive growth in the coming months.” Though Suzuki India is enduring its own woes during this time, the company still reported a 5.7-percent increase in sales during the 2019-2020 […]

Global Motorcycle Sales In Free Fall Due To COVID-19 Read More »