Honda launches a renewed 350 to rival Enfield Classic 350

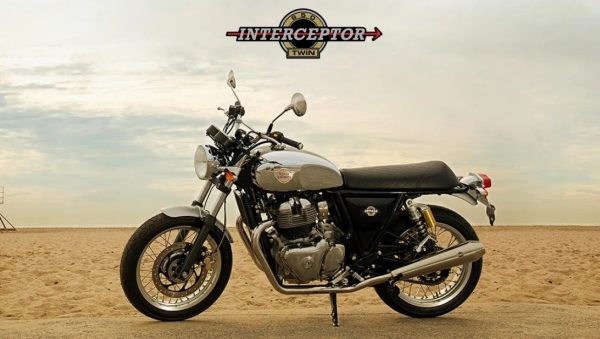

Honda CB350 launched at ₹2,00,000, will take on Royal Enfield 350. This is an even better retro-styled motorcycle from Honda than their previous 350 efforts in India and offers a lot of modern features that Enfield never has– at a price that can win customers over to their stable. Those who want an Enfield will listen to no reason nor rhyme to change their mind about their purchase. While it is primarily aimed at dethroning the King –Royal Enfield Classic 350 in sales pie-charts, it seems by co-incidence it will compete effectively with customers divided between Hero-made Harley-Davidson 440 and Bajaj-made Triumph Speed 400. Meanwhile, Enfield is sending Meteor to USA (well the motorcycle model, relax!) and Honda H’ness 350 which was first designed and launched in India was soon released in Japan as well. So will America see a Honda 350. It would be interesting if Honda and Kawasaki (Z650RS) brought the retro-styled motorcycles they presented in India to USA– because surely Harley-Davidson and Triumph won’t be bringing their 440cc and 400cc bikes over to ruin their American Dream of selling big bikes. Clearly, sales volumes in India, a more dynamic and responsive market than China, seems to tempt brands to change their strategies in their primary / major markets as well. All said, Honda still has a ‘big’ drawback with its sales and servicing of mid-weight bikes. Only Honda Big Wing brand of authorised dealers can sell and service these 350cc motorcycles apart from their other big engine bikes such as Fireblade, Africa Twin or Goldwing. This is silly because a 350cc engine is a common sight in all cities in India–thanks to Royal Enfield’s success at marketing and branding them. So, unless Honda leverages its vast number of dealers who sell 100cc to 150cc commuter motorcycles and […]

Honda launches a renewed 350 to rival Enfield Classic 350 Read More »