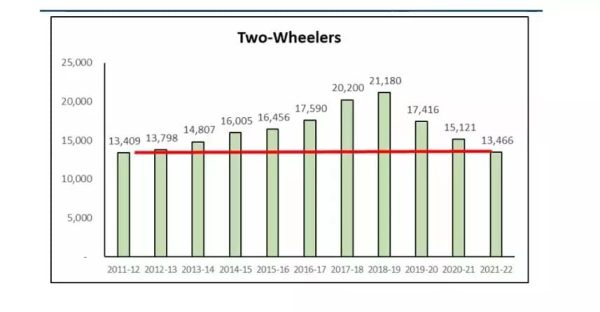

Two-wheeler sales crash to 10-year-low in FY22; motorcycles fall below 9 mn India is the largest manufacturer of two-wheelers and also the largest market for it. (China being second) One of the primary reasons for this downfall is the spiraling cost of fuel prices. by John from https://www.newswwc.com/ New Delhi: Rural distress impacted the Indian two-wheeler segment, one of the largest in the world, in a big way that their sales in 2021-22 fell sharply, for the first time in ten years, to 13,466,000 units, as per the latest data from the Society of Indian Automobile Manufacturers (SIAM). It was in 2011-2012 that the two-wheeler sales were close to this number at 13,409,00. ( India’s Financial Year is calculated as from 01-April-2021 to 31-March-2022 ) Throughout the year, demand for motorcycles and scooters was impacted by rural distress and higher ownership cost amidst soaring fuel prices. Sales of two-wheelers, particularly motorcycles failed to gather momentum even during the festive months, leaving the companies burdened with a pile of unsold stocks. As a result, the overall sales of motorcycles fell below the 9-lakh mark for the first time since 2016-2017, SIAM report said. One of the primary reasons for this downfall is the spiraling cost of fuel prices. Barring two months, petrol prices escalated in almost all months of FY22, sometimes even thrice a month that severely impacted the demand of entry-level motorcycles which is the primary choice of the budget-conscious low-income consumers. New motorcycle sales are directly correlated with fuel prices, as 62% of the country’s fuel sales are consumed by the two-wheeler segment. According to market experts, spike in auto fuel prices has triggered the rate of deferment majorly among the consumers of below 125cc two-wheelers that hold about 80% of the total market. Besides, shortage of semiconductors and