Mandate Madness: Latest Episode of Bandit’s Cantina

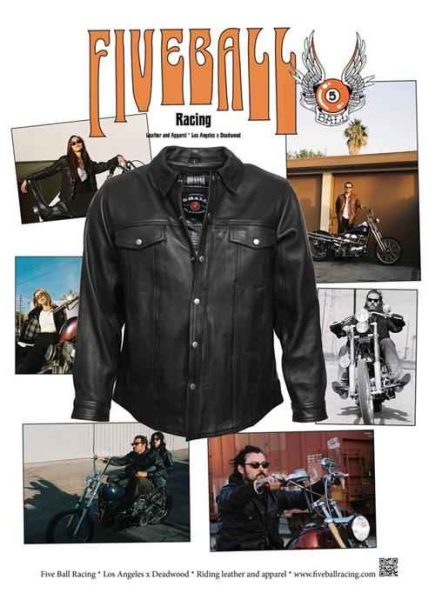

Bandit’s Cantina Episode 98: Mandate Madness Trying Business Survival in Los Angeles By Bandit with George Fleming and Jon Towle Illustrations Between Covid and multiple mandates, the Cantina business model imploded. It was no longer about food and parties. It was all about survival. Every Monday morning the staff met to discuss how to get through the next week. More and more young loners came to the Cantina to help or hide out. Walker’s Café on Pt. Fermin closed after almost 70 years as a coastal biker hangout. Between break-ins and anti-fossil fuel zealots Bikers were no longer allowed to ride along the scenic winding coast. Brothers who needed cash sold extra parts in a small swap area in the Cantina garages. Some gave parts to the Cantina to sell to pay the bills, others brought stuff to sell and split with the Cantina. CLICK HERE To Read Latest Episode of Bandit’s Cantina – The Series. Join the Cantina to catch-up on this incredible journey. Click Here to Sign-up before the 100th Episode Milestone.

Mandate Madness: Latest Episode of Bandit’s Cantina Read More »