Kawasaki Set to Electrify Its Entire Range in Developed Markets by 2035

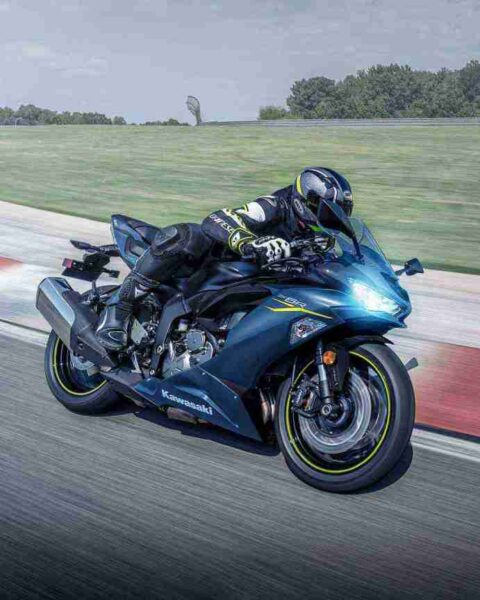

by Sergiu Tudose from https://www.autoevolution.com/ Japanese motorcycle manufacturer Kawasaki has announced that all its bikes sold in developed countries will become fully electric by 2035. They also plan on exploring hydrogen propulsion as more of a near-term solution, as they make the push towards carbon neutrality. While the global pandemic didn’t spare the motorcycle market, some people still view these two-wheelers as the best means of transportation, seen as how it carries with it the lowest risk of infection. According to Kawasaki chief executive Yasuhiko Hashimoto, his company is open to establishing a partnership with others in order to achieve their environmentally friendly objectives, reports BikesRepublic. “Outdoor leisure activity has been popular during the COVID pandemic. We will strengthen our environmental efforts with our sights set on post-pandemic lifestyles. Partnerships with other companies may be possible in the future,” he said. The first order of business is to launch a total of ten battery-powered motorcycles by 2025, before switching to EV power alone by 2035 in Japan, Europe, the United States, Canada and Australia. While short term plans might include new nameplates and “spin-offs”, if the company’s entire range is to be electrified within the next 14 years, that means fans need to start getting used to the idea of a fully-electric ZX-6R, ZX-10R or a Z650, just to name a few of their most popular (gasoline powered) models. Kawasaki sold 380,000 motorcycles last year, despite a global market share of roughly 1%, as per Nikkei Asia. The bikemaker does of course have a strong presence in both Japan and North America, driven by its best-selling motorcycles. As for its rivals, Honda is still the world’s largest motorcycle manufacturer. Yamaha meanwhile wants to make 90% of its models electric by 2050, which would put them somewhat behind the curve when […]

Kawasaki Set to Electrify Its Entire Range in Developed Markets by 2035 Read More »