Harley-Davidson hit with 56% EU tariff effectively blocking it from the EU market

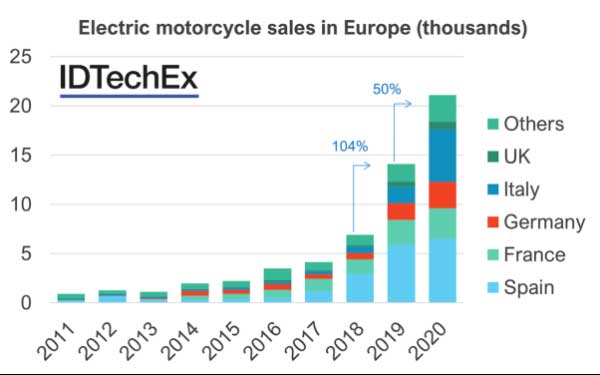

by Rick Barrett from https://www.jsonline.com Harley-Davidson hit with 56% EU tariff, an ‘unprecedented situation’ that will block the motorcycle maker from the market, CEO says Harley-Davidson Inc. has been slapped with a 56% European Union tariff on all its motorcycles, the company said Monday, effectively blocking it from the EU market. Harley said it would appeal the ruling scheduled to go into effect in June. “This is an unprecedented situation and underscores the very real harm of an escalating trade war to our stakeholders on both sides of the Atlantic. The potential impact of this decision on our manufacturing operations and overall ability to compete in Europe is significant,” Jochen Zeitz, Harley chairman, president and CEO, said in a statement. Europe is Harley’s second largest market after the United States. “Imposing an import tariff on all Harley-Davidson motorcycles goes against all notions of free trade and, if implemented, these increased tariffs will pose a targeted competitive disadvantage for our products, against those of our European competitors,” Zeitz added. In 2018, the European Union placed a 25% incremental tariff (31% total tariff) on motorcycles imported into the EU from the United States. Under the latest proposal, the EU would place a 50% incremental tariff on U.S. motorcycles for a total tariff of 56%. The ruling would even apply to Harleys manufactured in Thailand, where the company had set up operations to get around the 2018 EU tariff. Monday, Harley posted a quarterly profit of $259 million, or $1.68 a share, up from $70 million, or 45 cents a share, in the year-earlier period. Revenue rose to $1.4 billion from $1.3 billion a year earlier. “The actions we have taken to reshape the business are having a positive impact on our results, especially for our most important North American region,” Zeitz said. […]

Harley-Davidson hit with 56% EU tariff effectively blocking it from the EU market Read More »