Dynojet to Launch Its Power Vision Product for 2021 Harley-Davidson Touring & Softail Models

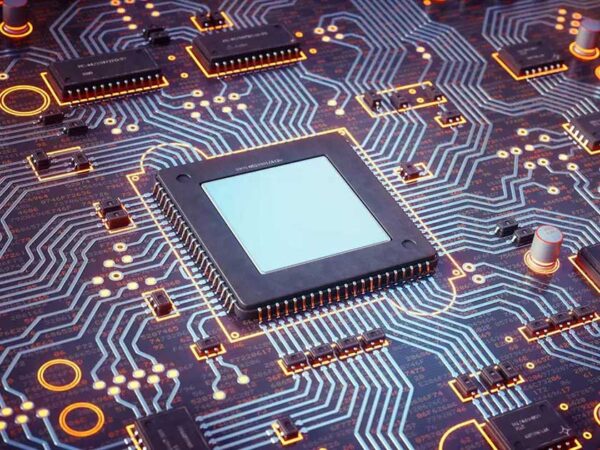

A world leader in developing and manufacturing performance enhancement products for vehicles is slated to unveil a new product. NORTH LAS VEGAS, NEVADA, UNITED STATES, September 15, 2021 /EINPresswire.com/ — Representatives with Dynojet Research, Inc. announced today that it will soon launch its Power Vision product for the 2021 Harley-Davidson. Dan Hourigan, Vice President of Product Management for Dynojet Research, Inc., explained that the Power Vision for 2021 Harley-Davidson Touring and Softails models (part number PV-3B) is slated to launch around Oct. 1. Dynojet Research, Inc. is the world leader in the manufacturing and development of performance enhancement products and tools. The company’s EFI tuning devices, diagnostic products and personalized services empower customers with the necessary resources to maximize performance and efficiency. As it relates to its soon-to-launch Power Vision product, Hourigan pointed out that some 2021 Harleys use a new ECU that required ground-up development efforts, while other models are already supported. The models using the new ECU include Touring, Softail, Pan-America, and Sportster S. The Power Vision PV-3B will support Touring and Softail to begin with, and then additional support will follow. The current Power Vision PV-2B already supports the remaining 2021 Harleys like the Sportster and Street 500/750. “No matter your brand of motorcycle or style of riding, our EFI tuning devices can help optimize power, torque, improved rideability, overall speed and fuel-efficiency,” Hourigan stressed before adding, “With our extensive library of dyno-tested tunes and the ability to flash your ECU at your convenience, you’ll have a tune for any combination of parts on your next adventure. Our Power Vision easily connects to your motorcycle through the OEM diagnostic connector, so installation is a snap. You can then flash your bike and unplug the device, or you can use it as an instrument panel for more information […]