Royal Enfield will have the highest number of new models

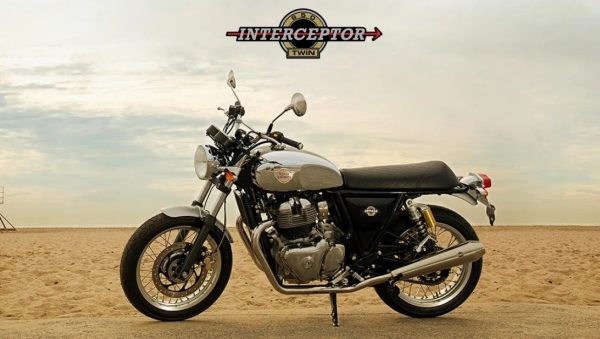

by Swaraj Baggonkar from https://www.moneycontrol.com Royal Enfield will have the highest number of launches this year: CEO Vinod Dasari This year, Royal Enfield is ready to introduce more models annually than ever before as the niche bike maker looks to further strengthen its iron grip on the middleweight motorcycle segment The Eicher Motors-controlled company that specialises in building bikes with engine sizes of 350cc to 650cc, currently, has its order backlog full. This can keep its factories running for the next 2-3 months without any new bookings. Speaking to analysts, Vinod Dasari, CEO, Royal Enfield, said: “We have a very exciting (product) pipeline. This year will probably see the highest number of new models that is ever seen from Royal Enfield in a year. And that is just the beginning of the pipeline.” Over the last few months, Royal Enfield launched the Meteor 350 and the new Himalayan, besides offering new colours on the 650 twins – Continental GT and Interceptor. Dasari did not provide details on the models that can be expected from Royal Enfield. “We will continue to have one new model every quarter. Because there is a delay due to COVID right now, I don’t think we will squeeze everything in but there are some very big models coming in. We are very excited about it. We will have to do all the marketing and market preparedness for that,” Dasari added. While sales of the 650 twins in India nearly halved to 10,256 units in FY21, largely due to COVID-19 disruption, Royal Enfield believes that there is space for more 650cc products. “Yes, there is a need to think about every platform. Not just the Twins, but Himalayan, Meteor and Classic. So we should think about every platform on how we can meet other kinds of customer […]

Royal Enfield will have the highest number of new models Read More »